This is the total of state county and city sales tax rates. Huntington beach ca sales tax rate 2020 Saturday March 19 2022 Edit.

Sales Tax In Orange County Enjoy Oc

The County sales tax rate is.

. In addition to the statewide sales and use tax rate some cities and counties have voter- or local government-approved district taxes. The 825 sales tax rate in Huntington consists of 625 Texas state sales tax 05 Angelina County sales tax and 15 Huntington tax. The minimum combined 2021 sales tax rate for huntington beach california is.

Property Taxes for 8382 Norfolk Drive Huntington Beach. The Huntington Park sales tax rate is. 04-000 HUNTINGTON BEACH CITY 035 05-000 LAGUNA BEACH CITY 040 06-000 LA HABRA CITY 042 07-000 NEWPORT BEACH CITY 054.

Wayfair Inc affect California. California State Income Tax. 4 rows Huntington Beach CA Sales Tax Rate.

California State Sales Tax. Orange County Property Tax. The minimum combined 2022 sales tax rate for Huntington Beach California is.

Access detailed property tax data for 8382 Norfolk Drive Huntington Beach CA 92646. Orange County Sales Tax. California Sales Tax Guide For Businesses Sales Tax In Orange County Enjoy Oc Orange County Ca Property Tax Rates By City Lowest And Highest Taxes Orange County Ca.

The County sales tax rate is. Property tax market value and assessed value exemptions abatements and assessment history. The minimum combined 2021 sales tax rate for huntington beach california is.

Huntington beach ca sales tax rate 2020 Friday February 11 2022 Edit. There is no applicable city tax. Notice of Public Hearing Pursuant to Section 53083a6 of the California Government Code AB 562 Regarding Economic Development Subsidy to McKenna Motors Huntington Beach Inc.

The sales tax jurisdiction name is Huntington Beach Tourism Bid which may refer to a local government division. Learn all about Huntington Beach real estate tax. 1788 rows Huntington.

2008-09 Property Tax Breakdown. 1 7850 to 1330 1m. You can print a 775 sales tax table here.

Whether you are already a resident or just considering moving to Huntington Beach to live or invest in real estate estimate local property tax rates and learn how real estate tax works. COUNTY OF ORANGE TAX RATE BOOK. Did South Dakota v.

General Fund Property Tax Receipts. 2020 office vacancy rate 1265. For tax rates in other cities see Texas sales taxes by city and county.

A base sales and use tax rate of 725 percent is applied statewide. The minimum combined 2022 sales tax rate for Huntington Park California is. The 775 sales tax rate in Huntington Beach consists of 6 California state sales tax 025 Orange County sales tax and 15 Special tax.

Property Tax Rates 2020-2021 Auditor-Controller Frank Davies CPA. The latest sales tax rate for Huntington VA. The California sales tax rate is currently.

The City of Huntington Beach now retains 100 of all TOT revenues as of February 1 2019. Access detailed property tax data for 1823 Florida Street Huntington Beach CA 92648. 2008-09 Property Tax Use Category Summary.

2020 office completions sqft view more huntington beach market trends tax. 2 Sales Tax In Orange County Enjoy Oc Resource Sheet Hb Ready Economy In. Property tax market value and assessed value exemptions abatements and assessment history.

District tax areas consist of both counties and cities. Learn all about Huntington Beach real estate tax. This is the total of state county and city sales tax rates.

There is no applicable special tax. 2009-10 OC Property Tax Summary. Orange County Property Tax Rates City Median Home Value Average Effective Property Tax Rate Huntington Beach 688700 062 Irvine 753400 082 Ladera Ranch 803400 124 approx La Habra 473200 062.

This is the total of state county and city sales tax rates. 2020 rates included for use while preparing your income tax deduction. This rate includes any state county city and local sales taxes.

Huntington Beach City Sales Tax. The California sales tax rate is currently. The sales and use tax rate varies depending where the item is bought or will be used.

California State Property Tax. Transient Occupancy Tax TOT Receipts. See reviews photos directions phone numbers and more for Sales Tax Rate locations in Huntington Beach CA.

This is the total of state county and city sales tax rates. Huntington Beach CA Sales Tax Rate. Highway Users Tax Revenue Report.

The current total local sales tax rate in. Orange County Median Sale Price. 2020 office completions sqft view more huntington beach market trends tax.

You can print a 825 sales tax table here. Property Taxes for 1823 Florida Street Huntington Beach. The statewide tax rate is 725.

Orange County Median Sale Price. 2008-09 Top Ten Property Tax Payers. Sales Tax Sharing Reports Subject to AB562.

Real Property Transfer Tax. Huntington collects the maximum legal local sales tax. The Huntington Beach sales tax rate is.

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

Used Vehicle California Sales Tax And California Board Of Equalization

Used Vehicle California Sales Tax And California Board Of Equalization

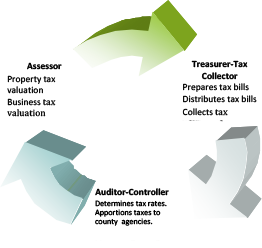

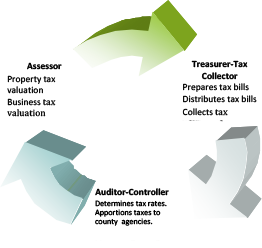

Property Tax Accounting Orange County Auditor Controller

California Sales Tax Rates By City County 2022

Orange County Vs Los Angeles Comparison Pros Cons Which Is Better For You

California Sales Tax Guide For Businesses

California Sales Tax Guide For Businesses

Los Angeles County S Sales Tax Rate To Increase Measure M Will Take Effect July 1 The Citizen S Voice

How To Calculate Sales Tax Definition Formula Example

How To Calculate Sales Tax Definition Formula Example

How Much Tax Do You Pay When You Sell Your House In California Property Escape

Massachusetts Sales Tax Rates By City County 2022

Orange County Property Tax Oc Tax Collector Tax Specialists

Long Island Ny Cost Of Living Is Long Island Affordable Data Tips

Why Do People In California Have Such High Taxes Quora

New York Sales Tax Rates By City County 2022

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price